Home refinance: Your property is our priority

If you are looking to lower your payment, increase your cash flow, or make a big purchase a home loan refinance may be perfect for you. Contact one of our local mortgage experts today by calling (810) 244-2134.

What's you get with a home refinance at FPCU:

- Local mortgage expert to guide you through the process

- Competitive rates and closing costs

- Convenient payment options

- Lifetime servicing of your loan

- Easy online application

Applying is easy. Select "Apply Online" below and "Create Account" to get started.

You may find it helpful to gather the following items before you begin:

- Information about your existing mortgage loan (if applicable)

- Pay stubs or recent tax returns to reference current income

- Bank statements and retirement account balances for assets

Once your application is submitted, you will receive a confirmation email from our team. A Financial Plus mortgage expert will get in touch to review next steps within 1 business day.

home-refi-calc

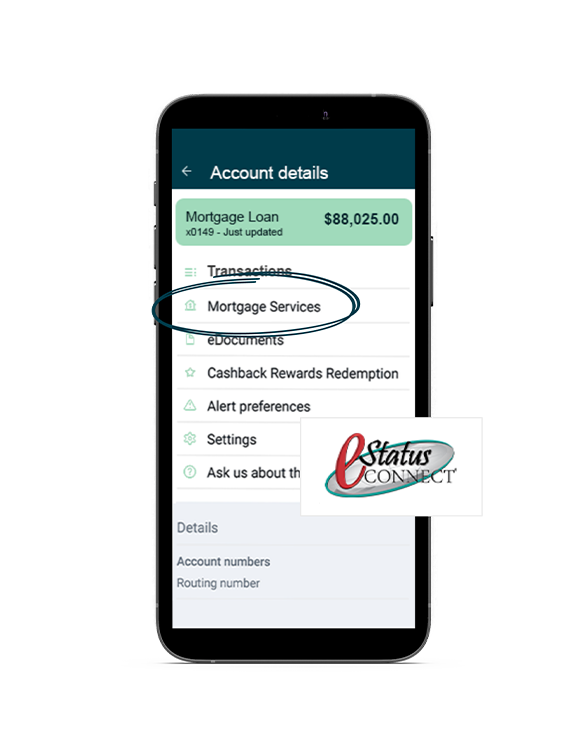

Manage your loan with eStatus Connect

Use eStatus Connect within your digital banking to make payments and view:

- Payment due date

- Payment history

- Current loan balances

- Previous and current year-to-date totals

- Upcoming interest and escrow changes

Conventional Fixed Rate

A fixed-rate mortgage comes with an interest rate that won't change for the life of your home loan. Monthly principal and interest payments on a conventional fixed-rate mortgage remain the same for the life of the loan making it an attractive option for borrowers who plan to stay in their home for several years.

Benefits and considerations:

- No interest rate surprises - the interest rate won't change for the life of your loan, protecting you from the possibility of rising interest rates

- The lowest fixed rate - Conventional mortgages may offer a lower interest rate than other types of fixed-rate loans

- Refinancing options available - Conventional fixed-rate mortgages are available for refinancing your existing mortgage, too - and 15- and 20-year options are especially popular.

Jumbo Loan

A jumbo loan is for someone financing a home in a highly competitive real estate market, exceeding conventional loan limit of $548,250 for a single-family home in Michigan. Jumbo loans come with different underwriting requirements versus a conventional loan and tax implications (see your tax advisor).

Federal Housing Administration

This program is designed to help borrowers in less-than-perfect financial situation buy homes. This program is especially useful for first-time homebuyers who may not have a lot for down payment. This also provides opportunities for refinancing.

Michigan State Housing Development Authority (MSHDA)

MSHDA loans are available to first-time homebuyers state-wide and repeat homebuyers in targeted areas. All homebuyers work directly with a participating lender. Household income limits apply and can vary depending on family size and property location. Down payment assistance is available.

- Sales price limit: $224,500

- Minimum credit score of 640 required or 660 for multiple-section manufactured homes

Rural Development (RD)

A rural development loan is a low interest, fixed-rate loan provided to qualified persons directly by USDA Rural Development. Financing is offered at fixed-rates and terms through a loan from a private financial institution and guaranteed by USDA Rural Development for qualified persons.

Solutions for every aspect of life

Mortgage Loan Officers and NMLS Numbers:

Financial Plus Credit Union - NMLS License #586579

Brooke Taylor-Huey, MLO - NMLS #642942

Rosemary Boan, MLO - NMLS #1531295

Amy Ricupati, MLO - NMLS #674678

Sherrie Dalton, MLO - NMLS #629441

Derek Lewis, MLO - NMLS #2335785

Rachelle Kippe, Senior Vice President of Lending - NMLS #423273

Lisa Shoemaker, Vice President of Mortgage Lending – NMLS #433133

Marcia Dinauer, Mortgage Sales Manager – NMLS #855164